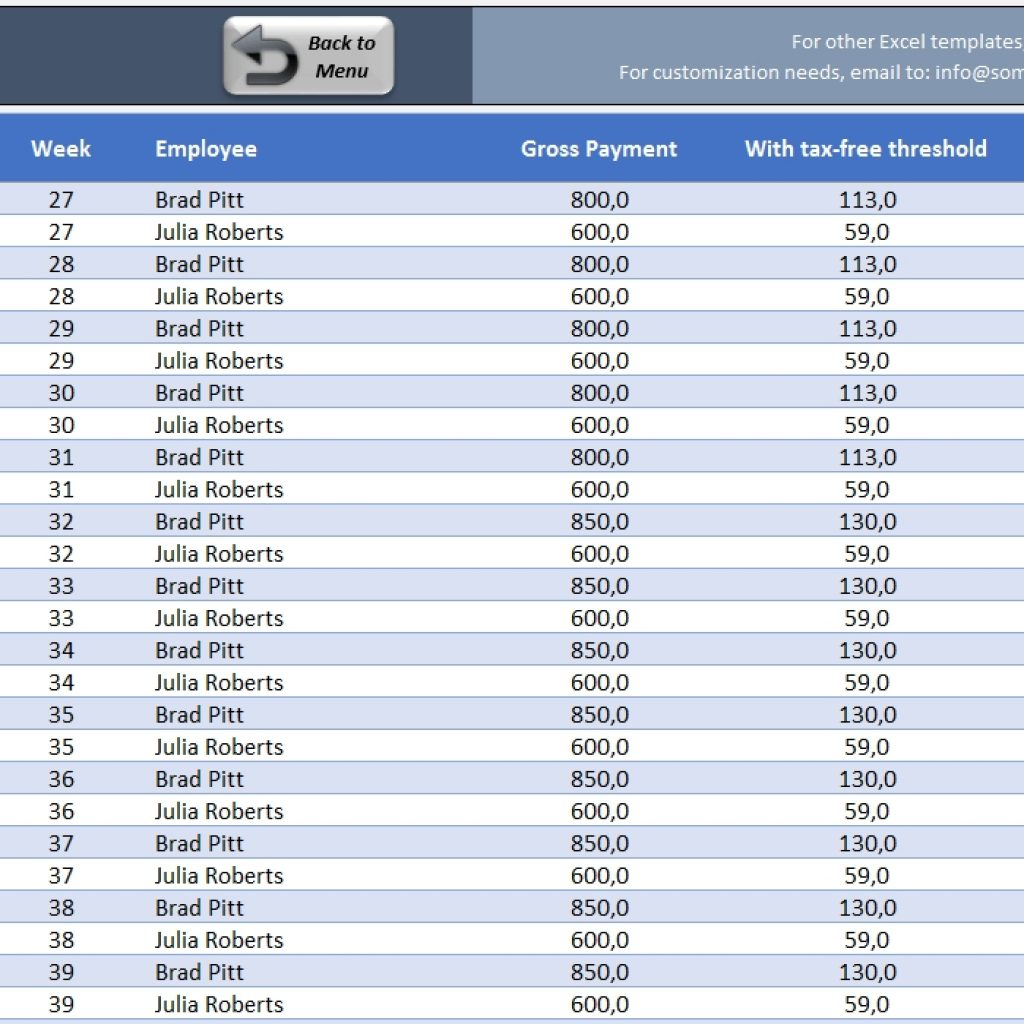

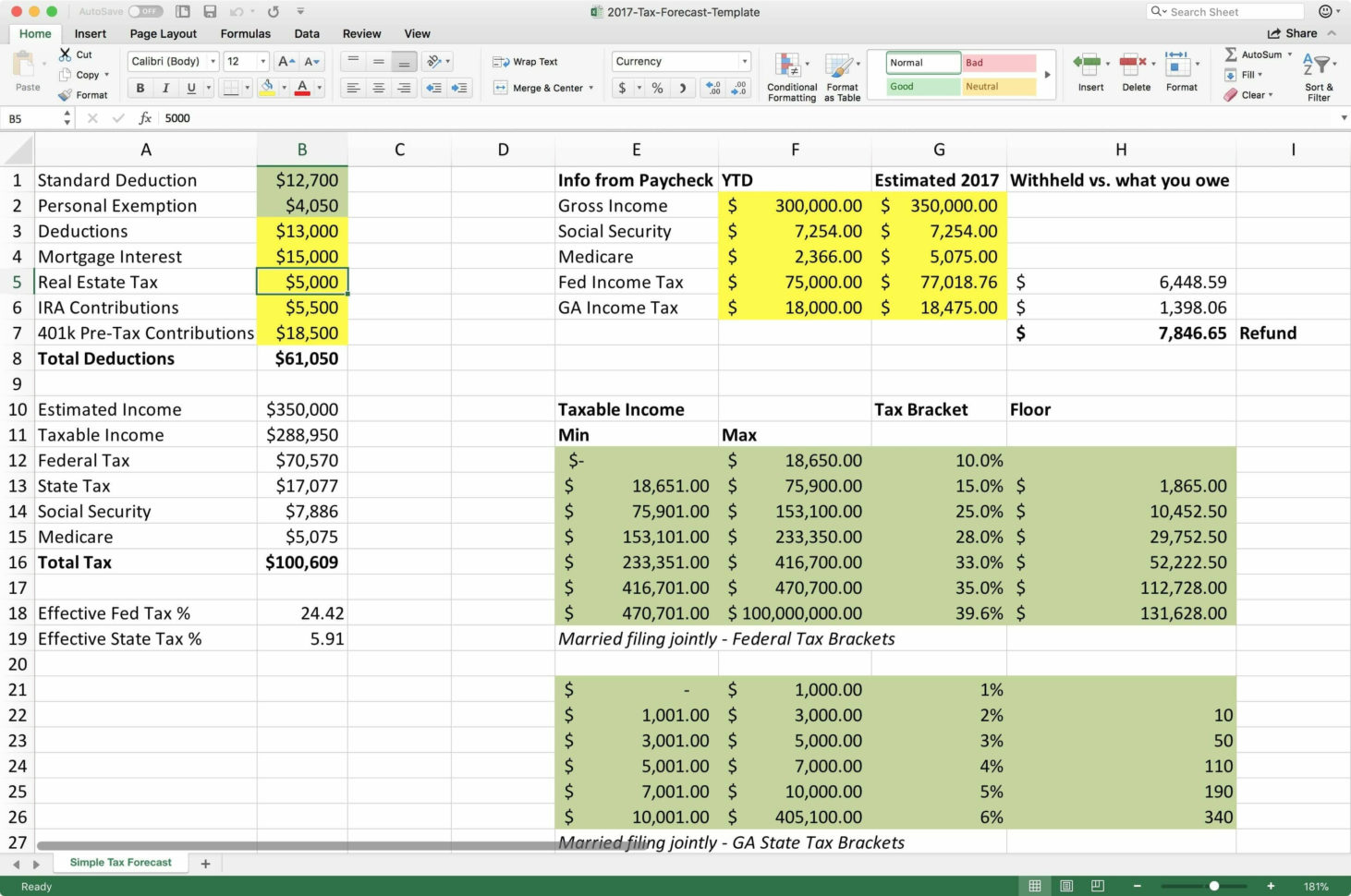

Please review your existing commitments such as contribution to employee provident fund, school fee payments, premium paid towards life insurance policies, repayment of housing loan, etc., which are eligible for Sec 80C tax investments. How much do Investment in Tax Saving Instruments? When you are preparing a detailed taxation plan, you must keep a few simple points. One of the frequently asked questions by salaried employees is: What are the factors should I consider while preparing a taxation & financial plan?įinancial planning linked with taxation is important for the salaried employees, where they invest their hard earned, limited sources to save tax as well to grow their wealth. Wish you a financially stress-free life and Prudent tax planning! Good Luck. Give to everyone what you owe them: If you owe taxes, pay taxes if revenue, then revenue if respect, then respect if honour, then honour.” Romans 13:1,6-7 “Let everyone be subject to the governing authorities, for there is no authority except that which God has established. Income Tax Calculator is Useful for the salaried employees of government and private sector. To calculate the taxable income, subtract total deductions and total exemptions from gross income in cell E5.Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 (FY 22-23) i.e.Firstly, you will calculate taxable income from gross income.

The steps for this method are as follows.

You can calculate income tax from taxable income. This is the easiest method to compute income tax in Excel format. Utilizing Taxable Income for Computation of Income Tax in Excel Format

You can see a sample data set given below that will help us compute income tax in Excel format.ġ. In this article, you will see the use of taxable income, tax brackets, the IF function, and the VLOOKUP function for the computation of income tax in Excel format. One of the main duties of citizens is to pay their taxes regularly. 4 Suitable Solutions for Computation of Income Tax in Excel FormatĪn income tax is a kind of tax that the government of one country imposes on its citizens based on their individual income.

0 kommentar(er)

0 kommentar(er)